What Is A Credit Score?

A credit score is a statistical analysis performed by financial institutions which determines the creditworthiness of a consumer. Your credit score significantly affects your financial life. Part of your financial hygiene is keeping your credit score healthy.

A person’s credit score will play a role in determining the amount they can borrow and the interest rate they will be assigned when purchasing a house, a car, etc. A person’s credit score may also be used to determine eligibility for such things as renting an apartment.

A credit score is a number that generally ranges from 300–850. The higher the score, the more trustworthy a borrower looks to potential lenders. Lenders access credit scores to evaluate the probability that a consumer will pay back loans on time.

What Is Considered A "Good" Credit Score?

Here is the typical range of what is considered a ‘good’ credit score:

- Excellent: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 300 to 579

How Is Your Credit Score Calculated?

Credit bureaus calculate your credit score using the information in your credit reports. The three primary agencies that produce credit reports in the United States are Experian, Equifax, and Transunion. Credit reports detail your credit activity – such as your history of paying bills on time (or not), your current credit accounts with the amounts and limits on them, and public records regarding liens, foreclosures, or bankruptcies. Each of the three credit reporting agencies uses a unique formula to score your credit, but the models generally account for similar information.

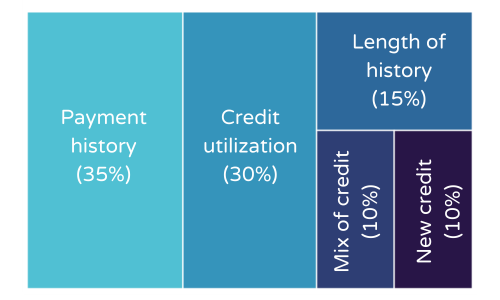

Payment history (35% or Most Important). Payment history details whether a person pays their credit obligations on time. If you have a corporate credit card (provided by your employer but in your name), timely payment on it can affect your personal credit score.

Credit Utilization (30% or Very Important). A ratio of credit available to a consumer vs. the amount they are currently using (for example, you have a credit limit of $20,000 on your credit card, but presently carrying $5,000). The Consumer Financial Protection Bureau’s guidance to consumers is to keep their credit utilization ratio below 30% (which would be below $6,000 in the previous example).

Length of credit history (15% or Somewhat Important). Long credit history is considered less risky than a short one. Your credit reports include information on the length of time your credit accounts have been open and when you last used them. The beginning of your credit life starts whenever you have your first credit “event” – i.e., opening a credit card, taking out a mortgage, financing a car, opening student loan accounts. To keep the average age of your credit high, avoid closing older accounts.

Mix of credit (10% or Less Important). A varied combination of types of credit accounts can help your score. Different credit types include revolving credit lines (like credit cards) and installment loans (such as car loans, student loans, personal loans, and mortgages).

New credit (10% or Less Important). A history of when you applied for new credit remains on your credit report for two years, but only affects your FICO score for 12 months. When you apply for new credit, the financial institutions will perform a “hard inquiry” on your credit. The number of recent inquiries your credit has had can affect your credit score.

Bankruptcy. Filing for bankruptcy can severely negatively impact your credit score, although it might be the most suitable decision for your financial situation. Depending on what type of bankruptcy you file (Chapter 7 or Chapter 13), your credit reports will report your default for seven to ten years.

Foreclosure. A foreclosure will have a significantly negative impact on your credit score. A foreclosure entry remains on your credit report for seven years.

Credit #Goals

Ambitious? Getting a credit score of 850 is achievable (but uncommon). Only 1% of all FICO scores in the United States achieve this lofty goal. How do they do it? Low credit utilization, zero late payments, and a long credit history.

Having an excellent credit score can save you money over your lifetime by allowing you to get lower interest rates. If you found this information helpful, share it with a friend. Also follow the Finance Foundry to learn how to maintain a healthy credit score.