The Importance of Tax-Advantaged Accounts

Different types of accounts that you can invest through have different tax treatment. If you are not taking advantage of tax savings when investing, you are not building wealth as quickly as you could be.

Which Accounts have Tax Advantages?

Health Savings Accounts (HSA). These accounts are known for their triple tax savings. You can spend the money on any qualified healthcare-related expenses. (Ladies – as of 2020, you can spend your HSA dollars on tampons!)

You can invest your HSA money. Keep some portion in cash, so you can spend it for medical purposes as needed, but invest the rest. Consider it part of your retirement savings. People regularly underestimate how much money they will need for healthcare expenses in retirement.

The only people who qualify for HSAs are those with high-deductible health insurance plans (HDHPs). HDHPs are becoming more common, so it is certainly worthwhile to look at your employer’s benefits and see if you qualify.

You own your HSA, which means that you keep it when you change employers.

An HSA also rolls over every year – you do not lose the money if you don’t spend it within the year. Do not confuse an HSA with a Flexible Savings Accounts (“FSA”). With an FSA, you either spend the money in the account every year or lose it. With an HSA, any money you don’t spend remains in your account and rolls over every year.

HSA contribution limits in 2021 are $3,600 for single-filers and $7,200 for families, with an additional $1,000 for those over the age of 55.

401(k) Plan. If your employer offers a 401(k) plan, try to make the most of it. Contributions to your plan lower your taxable income. The maximum contribution a single tax-filer can make to their 401(k) is $19,500 in 2021 (+$6,500 for those over age 50) – which may be significant enough to push you into a lower tax bracket.

If your employer makes contributions to your 401(k) plan, at a minimum, your contributions should be at least as much as needed to max out your employer’s contributions. If you do not take advantage of the match your employer offers, you are leaving money on the table – money that is set aside in your employer’s budget as part of your compensation.

The drawback of 401(k) plans is that you are generally limited in investment options. Your employer will choose what options will be available to you, but it is usually mutual funds (I’m not their biggest fan).

Traditional IRA. Also known as an ordinary or regular IRA. Contributions may be tax-deductible depending on your income and filing status. Amounts in your traditional IRA, including earnings and gains, will not be taxed until you make withdrawals.

There is no income limitation on contributions to a traditional IRA, but tax-deductibility phases out for high-income earners.

With self-directed IRAs, you can choose what to invest in (stocks, bonds, ETFs).

Roth IRA. With Roth IRAs, you invest post-tax dollars. While growing, dividends are not taxed. Once retired, withdrawals are not taxed.

However, there are income limitations with Roth IRAs. Between $125,000-$140,000 (single-filers) or $198,000-$208,000 (joint-filers), you can make limited contributions to a Roth IRA. If you earn more than $140,000 as a single-filer or $208,000 for joint-filers, you cannot make contributions to a Roth IRA. However – you may be able to utilize a “backdoor Roth IRA,” which is where you make contributions to a regular IRA and convert it to a Roth at tax time.

529 Plans. A 529-plan is a tax-advantaged investment vehicle used for funding the educational expenses of a designated beneficiary. Many states allow income tax deductions for contributions to a 529 plan.

The earnings generated by a 529 plan are generally not taxable, which allows them to grow untaxed. As long as the distributions pay for qualified educational expenses, distributions are not subject to federal or state income taxes.

529s have no annual income limitations, but they have lifetime contribution limits – which vary by plan. The lifetime contribution limit applies to the beneficiary of the 529 plan rather than the individual contributing.

For tax purposes, contributions to 529 plans are considered gifts. Individuals can gift up to $15,000 per year ($30,000 for married couples) per recipient, to an unlimited number of recipients, without incurring the federal gift tax.

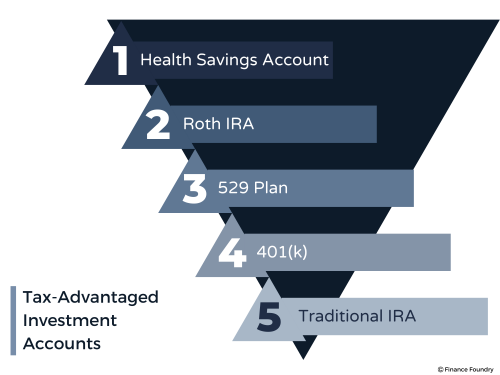

How Should You Sequence Utilizing Tax-Advantaged Accounts?

- Start by contributing enough to your 401(k) plan that you get the full match from your employer.

- Then max out your HSA if you are eligible (if you are in a high-deductible health insurance plan).

- Next, max out contributions to a Roth IRA account if you are eligible. Beware of income limitations that may phase out your contributions or eliminate eligibility.

- Now max out your 401(k) contributions up to the limit set by the IRS.

- If you have children whose education you want to contribute to, make contributions to 529 plans next.

- If you are ineligible to contribute to a Roth IRA, make contributions to a traditional IRA (which can be converted into a backdoor Roth IRA). If you have already maxed out contributions to a Roth IRA, you will not be able to make additional contributions to any type of IRA.

Then Move On to a Taxable Brokerage Account

With a taxable brokerage account, you can make unlimited contributions. Money that you put into a brokerage account is triple-taxed:

- The money contributed to the brokerage account has already been taxed as earned income.

- Any dividends you receive are taxed.

- Any capital gains you make are taxed.

Capital gains tax rate will vary depending on whether you held the underlying investment for more or less than 12 months (classifying it as short-term or long-term) and what your income tax bracket is.

Taxable brokerage accounts are more easily accessible, however, which is essential if you plan to retire early.