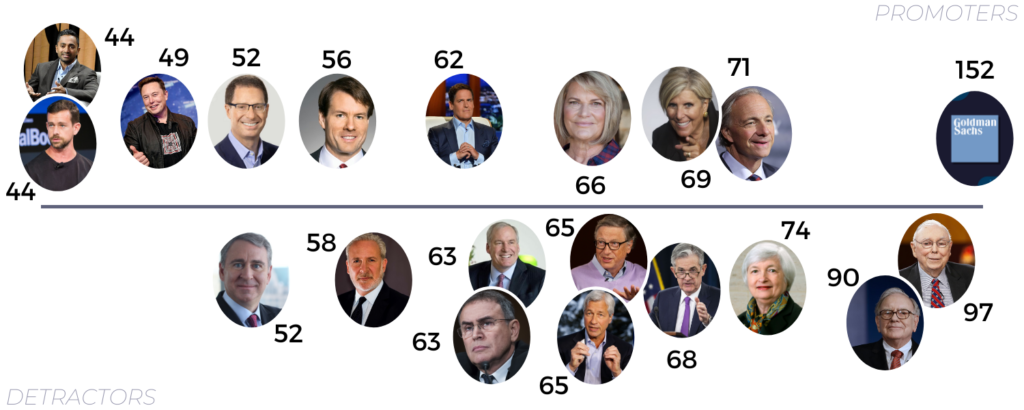

Who are Promoters

Michael Saylor. [56 years old] I would be remiss to talk about bitcoin promoters without mentioning Michael Saylor! Mr. Saylor is the co-founder and C.E.O. of Microstrategy, a business intelligence company. Saylor has recently become one of the biggest proponents of bitcoin. He and his company own significant investments in Bitcoin. In October 2020, Saylor disclosed he personally bought ~18,000 bitcoins. Throughout 2020 he steered Microstrategy’s cash into bitcoin, purchasing more than 70,000.

Mark Cuban. [62 years old] In April 2021, Mark Cuban said Bitcoin may still be far from its high: “the opportunity for it to go much higher certainly exists.” He believes that the number of people who own bitcoin has room to more than double. However, he thinks ethereum will grow to be much larger than bitcoin. As the Dallas Mavericks owner, Cuban announced that the basketball team would start accepting Dogecoin as payment. Mr. Cuban also stated, “for those of you who would like to learn more about Dogecoin, we strongly encourage you to talk to your teenagers … they will be able to explain it all to you.”

Chamath Palihapitiya. [44 years old] Some have dubbed Chamath Palihapitiya the “next Warren Buffet.” Best known as the King of SPACs [link], Palihapitiya is the founder and C.E.O. of Social Capital. Mr. Palihapitiya told his 67,000 Twitter followers that cryptocurrency was the “ultimate insurance policy against autocracy.” He appears to be more bullish on bitcoin than ethereum. He also has speculated that N.F.T.s will be the next frontier.

Cynthia Lummis. [66 years old] Senator Cynthia Lummis is the first known Bitcoin owner elected to Congress. She currently serves in the U.S. Senate as a representative for Wyoming. She has been an outspoken advocate for Bitcoin in the U.S. Senate. She is on a mission to promote an understanding of Bitcoin among U.S. regulators.

Goldman Sachs. [152 years old] Goldman Sachs re-activated its crypto desk early in 2021 and doubled its hiring. They are expanding their services to now deal bitcoin futures to clients. Goldman realized that there was massive demand from its client base when it issued a survey to 300 of the firm’s clients and found that 40% already had holdings in crypto. Goldman first set up a cryptocurrency desk in 2018 and then took a 3-year hiatus due to regulatory concerns. They are now exploring what it would take to launch a bitcoin ETF.

Suze Orman. [69 years old] Personal Finance T.V. personality Suze Orman has stated: “I love bitcoin … I like that it’s just there and the corporations that are investing in it.” She does not support it as a currency, however, but as a replacement for gold. She warns her followers that crypto investing can be highly volatile, noting, “bitcoin is seriously risky.”

Brian Brooks. [52 years old] Brian Brooks is the former acting chief of the Office of the Comptroller of the Currency. He was chief counsel at Coinbase before joining the O.C.C. Mr. Brooks was known for his friendly attitude towards crypto on social media. In April 2021, Binance.US hired Mr. Brooks as its C.E.O. (yes, another cryptocurrency company seeking to strengthen its ties with Washington). Mr. Brooks had a difficult upbringing and believes blockchain technology can help the underbanked change their lives.

Ray Dalio. [71 years old] – Ray Dalio is a hedge fund billionaire and co-Chief Investment Officer of Bridgewater Associates. In 2017, Mr. Dalio described bitcoin as a bubble, stating. “it’s not an effective store hold of wealth because it has volatility to it, unlike gold. Bitcoin is a highly speculative market.” He has since decided that bitcoin has “stood the test of 10 years time” and is now a vital component of a well-diversified portfolio. Dalio recommends investors allocate 20% of their portfolios to bitcoin. What made him change his mind about bitcoin? He likes that “[similar] to gold, it cannot be devalued by central bank printing,” “its total supply is limited,” and “it is easily portable and exchangeable globally.” However, he notes the U.S. government outlawing bitcoin is a “good probability,” facing a similar fate as gold did in the 1930s.

Jack Dorsey. [44 years old] Jack Dorsey is the co-founder and C.E.O. of Twitter and the founder and C.E.O. of Square. Dorsey’s company Square (parent of the Cash App) announced in October 2020 that it purchased $50 million worth of Bitcoin. The company highlighted its confidence in bitcoin as an instrument for economic empowerment and revealed in February 2021 that it added $170 million worth of bitcoin to its holding. Dorsey has said he is passionate about bitcoin because of the “model it demonstrates” for decentralization. In February 2021, Jack Dorsey teamed up with rapper Jay-Z to establish a bitcoin development fund. Mr. Dorsey has pledged $10 million to invest in cleaner Bitcoin mining technologies.

Elon Musk. [49 years old] As an active Twitter participant, this entrepreneur has been vocal in support of cryptocurrencies. In February 2020, Musk’s company Telsa announced it had purchased $1.5 billion worth of Bitcoin. In March 2021, Musk announced that Tesla would start accepting Bitcoin as payment. In April, he tweeted out, “What does the future HODL?” in reference to the popular crypto-community term “HODL,” meaning “Hold On for Dear Life.” Elon caused waves in May when he tweeted out that Tesla would pause on accepting Bitcoin as payment due to environmental concerns and followed up the next day that he was meeting with mysterious “DOGE developers.”

Who Are Detractors

Janet Yellen. [74 years old] Janet Yellen is an economist who has served as the Federal Reserve chair (2014-2018). Ms. Yellen is the first female to serve as U.S. Treasury Secretary. She is a Keynesian economist, ascribing to the philosophy that markets are fundamentally flawed and require government regulation to function correctly. In February 2021, Ms. Yellen sounded the alarms on Bitcoin. She describes it as “extremely inefficient” and “often [used] for illicit finance.” She did not comment on the efficiency or illicit use of the U.S. dollar.

Bill Gates. [65 years old] – The former Microsoft C.E.O. revealed in April 2021 that he is betting on a total collapse of cryptocurrencies. He also added to Yellen’s comments about energy inefficiency, noting that: “bitcoin uses more electricity per transaction than any other method known to mankind. It’s not a great climate thing.” Gates has previously stated that he has a “neutral view” on bitcoin, meaning that he is not short the crypto; he just does not own any. During an interview in 2018, Mr. Gates explained why bitcoin has no real value, stating, “as an asset class, you’re not producing anything, and so you shouldn’t expect it to go up. It’s kind of a pure ‘greater fool theory’ type of investment.”

Peter Schiff. [58 years old] Gold bug Peter Schiff is a financial commentator and C.E.O. of Euro Pacific Capital. He is an outspoken critic of bitcoin and has compared it to the beanie babies craze of the 1990s – noting that beanie babies were potentially more useful (you could shove them between your walls and use them for insulation). Schiff frequently warns that the U.S. economy and dollar are headed for a crash. He also warns that bitcoin is merely used for speculation: “once nobody wants your bitcoin, it’s completely worthless.”

Warren Buffett. [90 years old] Warren Buffet is an American investing tycoon. He started investing at age 11 and reached billionaire status in his 50s. Buffett is famous for his common sense value investing style. On bitcoin, Mr. Buffett believes “it will come to a bad ending.” The Oracle of Omaha has compared bitcoin to rat poison and said it is more like gambling than investing. He notes that bitcoin is a nonproductive asset, meaning it creates nothing.

Charlie Munger. [97 years old] Charlie Munger is known as Warren Buffet’s right-hand man. The billionaire investor has spoken sharply of bitcoin, saying it is “disgusting and contrary to the interests of civilization. He notes that “of course [he] hates the bitcoin success.” Munger has said that bitcoin is too volatile to ever replace traditional currencies: “I don’t think bitcoin is going to end up the medium of exchange for the world.” Mr. Munger has concluded his crypto investing strategy like this: “since I never buy gold, I never buy any bitcoin.”

Eric Rosengren. [63 years old] Eric Rosengren is the President and C.E.O. of the Boston Federal Reserve Bank. Mr. Rosengren has noted his surprise at bitcoin’s continued success. “I would suspect, down the road, that a number of central banks will have digital currency. When there is a digital currency available, other than the underground economy, it’s not clear why people would use Bitcoin.” Rosengren suspects that eventually, bitcoin’s price will come under pressure.

Ken Griffin. [52 years old] Ken Griffin is the founder, C.E.O., and co-Chief Investment Officer (and 85% owner) of the $38 billion hedge fund Citadel. Mr. Griffin has been dismissive of cryptocurrencies to date, stating that he “doesn’t know how to think” about bitcoin. He explains, “I understand how to value a stock, I understand how to think about currency exchange rates around the world. I don’t know how to think about what is effectively a digital token.” Griffin believes he lacks an understanding of the economic underpinning of cryptocurrencies.

Jerome Powell. [68 years old] Jerome Powell is the Federal Reserve chair, serving in that position since 2018. Seen as bipartisan, he was nominated to the Federal Reserve Board by Barack Obama in 2012 and subsequently appointed to the Chair position by Donald Trump. Mr. Powell has admitted that bitcoin is essentially a substitute for gold. However, he cautions that cryptocurrencies are highly volatile and therefore not useful stores of value given that “they’re not backed by anything.”

Nouriel Roubini. [63 years old] Nouriel Roubini is an economist and professor at N.Y.U.’s School of Business. Mr. Roubini has long been a critic of cryptocurrencies. He believes the fundamental value of bitcoin is zero and that “if a proper carbon tax was applied to its massive polluting energy-hogging production, I predict that the current bubble will eventually end in another bust.” He also notes that bitcoin is not a scalable payment method, “with bitcoin, you can do five transactions per second while the Visa network does 24,000.”

Jamie Dimon. [65 years old] Jamie Dimon is the Chairman and C.E.O. of JPMorgan Chase. In October 2017, Jamie Dimon said, “I’m not going to talk about bitcoin anymore.” Mr. Dimon has referred to bitcoin as a fraud, comparing it to the tulip bulb mania of the 1700s, or even worse. At one point, Mr. Dimon warned that he would fire JPMorgan traders immediately if he caught them trading bitcoin. In November 2020, Mr. Dimon stated that bitcoin was still not his cup of tea. He believes bitcoin’s underlying technology, blockchain, has a future. In January 2021, JPMorgan analysts said bitcoin’s price could go to $146,000.